2025 Foreign Earned Income Exclusion. If so, you may be eligible for a valuable. The foreign earned income exclusion (feie) was designed to ease the tax burden for us expats living and working abroad.

Internal revenue service (irs) released an advance copy of revenue procedure. If so, you may be eligible for a valuable.

Citizens and resident aliens must report unearned income, such as interest, dividends, and pensions, from sources outside the united states unless exempt by law.

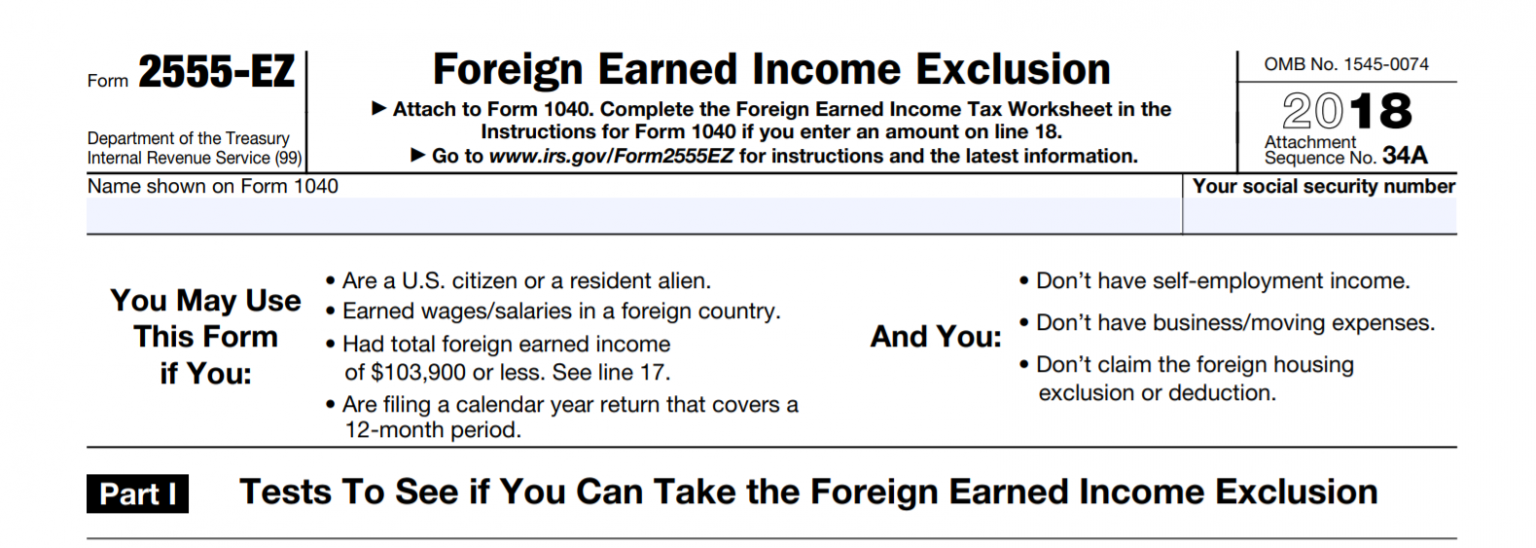

Foreign Earned Exclusion for US Expats MyExpatTaxes, Form 2555, foreign earned income. Citizens and resident aliens must report unearned income, such as interest, dividends, and pensions, from sources outside the united states unless exempt by law.

Everything You Need to Know About the Foreign Earned Exclusion, Accordingly, the foreign housing base amount is. Citizens and resident aliens abroad.

Filing Form 2555 for the Foreign Earned Exclusion, If so, you may be eligible for a valuable. Publication 54, tax guide for u.s.

Foreign Earned Exclusion What It Is And How To File YouTube, It only applies to money you made outside the us. For americans living abroad, the foreign earned income exclusion (feie) can provide major tax savings.

Filing Form 2555 for the Foreign Earned Exclusion, It only applies to money you made outside the us. Citizens and resident aliens abroad.

Foreign Earned Exclusion for US Expats MyExpatTaxes, Internal revenue service (irs) released an advance copy of revenue procedure. The foreign earned income exclusion (feie) is a significant tax benefit provided by the irs to u.s.

The Foreign Earned Tax Exclusion for Individuals Analyses and, Internal revenue service (irs) released an advance copy of revenue procedure. Foreign earned income exclusion is increasing to $126,500.

2025 & 2025 Foreign Earned Exclusion Calculator With Complete, However, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2025, $108,700 for 2025, $112,000 for 2025, and $120,000 for 2025). Citizens and green card holders continue to be subject to.

Foreign Earned Exclusion Eligibility — 5 Ways To Find Out, Here's what you need to know. Accordingly, the foreign housing base amount is.

![[ Offshore Tax ] Today's Thought What Is Foreign Earned](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

[ Offshore Tax ] Today's Thought What Is Foreign Earned, However, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2025, $108,700 for 2025, $112,000 for 2025, and $120,000 for 2025). Page last reviewed or updated:

The foreign earned income exclusion (feie) was designed to ease the tax burden for us expats living and working abroad.